Abstract

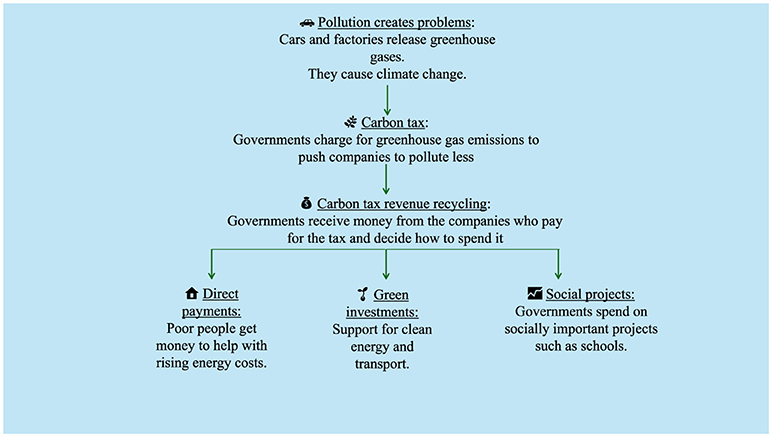

Scientists generally agree that making companies pay for their own greenhouse gas pollution is effective. This is called paying carbon tax, and the tax can help fight climate change by making people want to burn less polluting fuels, for instance, by using electric cars or solar panels for heating. However, most countries that charge carbon tax do not charge enough money to make big changes. This is because the governments worry that people will say the extra taxes are unfair. One way to help people accept a carbon tax is called revenue recycling. That means the government uses the tax money to help people. Scientific evidence has shown that, if the money is spent in smart ways—like helping schools or families—more people agree with the tax. This article looks at how using carbon tax money wisely can help stop pollution and make big changes for the climate.

A Quick Story With a Happy Ending

Climate change has already had some serious effects on people’s lives, and it is getting worse because we are not doing enough to stop it or even limit its impact. Why do people not simply act together powerfully to stop climate change? How can we make politicians, companies, and communities around the world interested in climate action? Here is a short story that describes one idea:

Imagine a town with lots of big cars that puff out dirty air. The dirt is made of carbon. So, the town makes a rule: every day that you pollute, you must put 25 cents into a special box. This quarter is called a carbon tax. The money in the box is called revenue, which means money that is earned. The town decides to reuse the revenue to help the community—this is called revenue recycling. Every month, they open the box and use the money to build parks, pay for school lunches, or help families heat their homes in winter. Each year, the town makes a new plan for how much to pay into the box and how to spend the money. Soon, the air gets cleaner. People want to pollute less and save their quarters. And the town has greener parks, warmer homes, and happier kids.

The following graph (Figure 1) gives you an overview of how carbon tax revenue recycling works.

- Figure 1

- How carbon tax and revenue recycling work.

So now you know WHAT carbon tax is and WHY it might help society and the environment. Let’s dive into the science behind it, how it works and how it could work better!

The Challenge of a Tax on Carbon

Scientists have been saying for a long time that carbon taxes are the best way to tackle climate change. Some climate policies make people pay for the greenhouse gas pollution caused by their factories, cars, buses, airplanes, and air conditioners. But this carbon tax is expensive for some people. The idea behind charging a carbon tax is that people will want to avoid paying it, so they will switch to using things that do not burn fossil fuels or cause pollution. Non-polluting things use sustainable energy—energy that will not run out and does not harm the environment—like solar-powered lights and electric buses.

The problem is, even though the carbon tax can lead to good things, many people think paying any tax for pollution is unfair. And, if the amount of the tax, called the carbon price, is unpopular, politicians who support it may not get elected. If they do not get elected, they cannot take any climate action. Let us look at why carbon taxes may seem unfair.

First, poor people struggle harder to pay for transportation and for heating and cooling their homes than rich people do. A carbon tax makes their energy and transportation bills even higher. Telling them, “It is to help the environment”, may not be enough. “How will it help us?” they might ask (Do not worry, we will get to that).

Or they might say, “We do not believe that paying more for something will make people use less of it, or switch to a non-polluting product”. For example, many people like to keep their homes warm in winter or need their cars to go to work. So, even if their energy bills or the cost of gasoline goes up, they may not change their habits or reduce how much they use. This is true in some cases.

Because of these problems, the government keeps the tax too low to do all the great things it could do. But do not worry, because even at these low carbon prices, there is now plenty of evidence that carbon pricing is effective in reducing greenhouse gasses, and it does make some people and companies change their behavior or switch to products that use sustainable energy [1]. For example, since the carbon tax began in the European Union, people have been using less polluting coal to heat their homes and for electricity. And they use more renewable energy sources, like solar and wind power. The question is, how can we improve climate policies so that more people accept and support them?

Ways to Win Support for Carbon Tax

There are several ways to improve the acceptance of climate policies like the carbon tax. First, politicians and scientists must educate the public more about how taxing carbon to reduce pollution can help our environment—cleaner air, fewer terrible storms, and saving natural resources, like clean water. In addition to educating people about this urgent issue, we need to recycle the tax revenue. As you learned in the story, revenue recycling means taking the money that governments collect in carbon taxes and giving it back to the people! The tax may not seem unfair if it is used to help poor households pay for heating their homes or for gasoline to drive their kids to school [2]. Going further, carbon tax money can be used to pay for eco-friendly products and projects, like putting solar panels on the roofs of homes and companies. Projects like these make energy cheaper and cleaner for everyone, proving that climate policies are good for the environment and for people’s wallets.

There is more. If people are aware of serious problems in their society, such as poor education or health care, the government can promise to spend the carbon tax revenue they will collect that year helping those areas. Who would complain about better schools and hospitals?

Table 1 shows how some countries use the carbon tax revenue in socially and environmentally helpful ways.

| Country | What the money is used for |

|---|---|

| Ireland | Supporting eco-friendly changes for farmers and families, and helping poor people |

| Colombia | Working toward peace by paying for environmental projects |

| Portugal | Reducing taxes for big families and supporting forest-growing projects |

| China | General budget: the money is used for many different projects |

| Luxembourg | Climate action programs and helping families by lowering taxes |

| Switzerland | Reducing health insurance costs and supporting eco-friendly buildings, |

- Table 1 - Some great things that revenue recycling does for countries.

My Research on Carbon Taxes

When more people see positive results, they begin to support carbon taxes, and politicians are more likely to create policies that include higher carbon prices. The higher the price, the more revenue they will receive to protect the environment.

Of course, countries are all very different from each other, so the same revenue recycling plans will not work everywhere. In some countries, where there are more poor people, governments need to spend money helping people afford the higher price of the carbon tax. Other countries face bigger threats from climate change, such as rising sea levels that can flood their streets and cities. In these countries, the revenue can help them prepare for climate change, like building sea walls to protect communities from the rising ocean.

To figure out which revenue recycling methods will work best, we need to look at the specific situation in each country. We need to understand how much business the country does, how much pollution the country makes, and how much of the population is rich vs. poor. Then policies can be designed to help each situation.

My research looks at three main ways of using the money from a carbon tax: (1) helping poor people or people who live far from cities; (2) working on projects that help the environment; and (3) spending revenue on important social causes, like education. The idea is that, if people’s needs are taken care of, they will be willing to pay more for the pollution they make.

The Big Result: Helping Environment and Society Together

One of the most important things my research shows is that, in richer countries with better education and technology, people are generally willing to pay higher taxes even if the revenue is not used to help the community. But in many countries that cannot survive without their polluting factories and transportation, or countries that have many poor people, politicians should use the tax revenue to help the people. If the money can both help the poor and also pay for eco-friendly projects, then people are even more willing to pay higher carbon prices.

I also hope the people in government can use what I have learned through my research to make better rules and smarter choices. How can they do that? By spending the money from carbon taxes wisely!

But to spend wisely, they have to know what people really need. Think about your parents—they try to find out what you need for school, or what you might want for your birthday. Sometimes they even ask you. Politicians should be like that too. They should listen to the public—and that includes kids!

You may not be able to vote yet, but you can still help change minds—including the minds of politicians. When grownups and kids speak up, ask questions, and share what they have learned, leaders start to pay attention. As more people understand why carbon taxes matter, they will support politicians who take real action to protect our planet.

Glossary

Carbon: ↑ short expression for greenhouse gas emissions that cause climate change.

Carbon Tax: ↑ Policy that makes companies and people pay for their greenhouse gas emissions and pollution.

Revenue: ↑ Funds received from companies and people paying for carbon tax.

Revenue Recycling: ↑ Different ways governments spend carbon tax revenue.

Policies: ↑ Governments’ plans to solve important issues.

Sustainable Energy: ↑ Energy that will not run out and does not harm the environment.

Carbon Price: ↑ Level of carbon tax which determines how much money people have to pay for pollution.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Original Source Article

↑Muth, D. 2023. Pathways to stringent carbon pricing: configurations of political economy conditions and revenue recycling strategies. A comparison of thirty national level policies. Ecol. Econ. 214:107995. doi: 10.1016/j.ecolecon.2023.107995

References

[1] ↑ Best, R., Burke, P. J., and Jotzo, F. 2020. Carbon pricing efficacy: cross-country evidence. Environ. Resour. Econ. 77:69–94. doi: 10.1007/s10640-020-00436-x

[2] ↑ Maestre-Andrés, S., Drews, S., and Van den Bergh, J. 2019. Perceived fairness and public acceptability of carbon pricing: a review of the literature. Clim. Policy 19:1186–1204. doi: 10.1080/14693062.2019.1639490

[3] ↑ Muth, D. 2023. Pathways to stringent carbon pricing: configurations of political economy conditions and revenue recycling strategies. A comparison of thirty national level policies. Ecol. Econ. 214:107995. doi: 10.1016/j.ecolecon.2023.107995